Forex trading is all about timing and precision. But how do you know which currency pairs will give you the best opportunities? Many traders struggle with identifying the strongest and weakest currencies, which can lead to missed opportunities or poor trade decisions. By understanding currency strength, traders can make more informed decisions and optimize their strategies for better results.

Currency strength plays a crucial role in forex trading. Since every forex trade involves a currency pair, understanding which currency is strong and which is weak helps traders anticipate price movements more accurately.

For example, if the U.S. dollar (USD) is gaining strength while the Japanese yen (JPY) is weakening, traders can look for potential long opportunities in USD/JPY. Similarly, selling a weak currency against a strong one increases the probability of successful trade.

Historically, traders have used two main approaches to assess currency strength:

This involves tracking economic indicators like:

Traders use tools such as:

While effective, these methods demand time, expertise, and extensive research. For real-time trading, they often fall short, delaying critical decisions.

Modern forex traders leverage technology to make data-driven decisions. Instead of manually analyzing multiple currency pairs, real-time currency strength indicators provide a clear and instant overview of the strongest and weakest currencies.

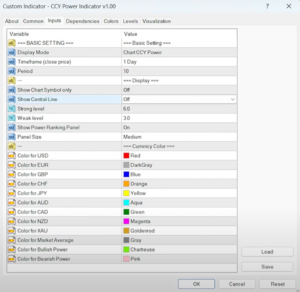

The CCY Power Indicator is one such tool that allows traders to view the strength of the 8 major currencies and gold in real-time. By visually representing currency power using easy to differentiate colours, traders can easily determine the best market entry points without complex calculations.

Once traders have access to real-time currency and gold strength data, they can implement effective trading strategies:

Understanding currency strength is a game-changer for forex traders. Instead of spending hours analyzing multiple indicators, tools like CCY Power provide an efficient way to make informed trading decisions. Whether you’re a beginner or an experienced trader, leveraging real-time currency strength data can significantly enhance your trading accuracy.

Want to see how CCY Power can improve your trades? Watch our video below on the introduction of CCY Power!

Whether you are a beginner or an experienced trader, you can start learning about algorithmic trading by joining our FREE online course.

To get started, visit https://algoforest.my/.

外汇小课堂:外汇交易如何运作︖了解外汇交易的基本原理 外汇交易作为全球交易量最大、流动性最高的金融市场之一,每天的交易总额高达 6.6 兆美元,吸引了无数投资者参与。然而,对于许多外汇新手来说,外汇到底是怎么运作的?是否真的如传说中那般高风险、难以掌握? 本文将带您逐步了解外汇市场的基本架构和操作方式,帮您扫清学习过程中的疑惑。不论您是初学者还是稍有经验的交易者,都可以从本文中获得实用的信息与策略。 外汇交易的基本原理是什麼︖ 外汇交易的核心是「以一种货币兑换另一种货币」,也就是所谓的「货币对」。例如 EUR/USD(欧元/美元)代表购买一欧元所需的美元数。 每种货币都有其标准缩写,例如 EUR 是欧元、USD 是美元。通过查看这些货币对的价格,交易者可以判断当前汇率,并作出买入或卖出的决策。 外汇价格由市场供需决定,全天候波动,因此也为交易者提供了众多机会。 📌 实用小贴士:可通过连接至权威外汇网站查看实时汇率。...

LEARN MORE >>MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two of the most popular trading platforms...

LEARN MORE >>The rise of artificial intelligence (AI) is reshaping forex trading, making automated trading smarter, faster,...

LEARN MORE >>